tushare financial data interface package

- pip install tushare

- Function: provide relevant specified financial data

- Related documents: Tushare - financial data interface package

Demand: stock analysis

Use the tushare package to obtain the historical quotation data of a stock.

- tushare financial data interface package, based on which historical trading data of any stock can be obtained

- pip install tushare

data processing

Use the tushare package to obtain the historical quotation data of a stock

df = ts.get_k_data(code='600519',start='2010-01-10')

Persistent storage of DF df.to_xxx()

#Store df's data locally

df.to_csv('./maotai.csv')Load external data pd.read_xxx()

#Load external data into df: read_xxx()

df=pd.read_csv('./maotai.csv')

print(df.head())Output results

Unnamed: 0 date open close high low volume code 0 5 2010-01-11 104.400 102.926 105.230 102.422 24461.03 600519 1 6 2010-01-12 103.028 105.708 106.040 102.492 31063.40 600519 2 7 2010-01-13 104.649 103.022 105.389 102.741 37924.44 600519 3 8 2010-01-14 103.379 107.552 107.974 103.379 46454.64 600519 4 9 2010-01-15 107.533 108.401 110.641 107.533 45938.50 600519

Delete Unnamed: 0 column

In the drop series of functions

- axis=0 represents the row and 1 represents the column

- inplace=True will delete the original data directly

#Delete Unnamed: 0 column df.drop(labels="Unnamed: 0",axis=1,inplace=True) #inplace=True means that the original column is deleted and not saved print(df.head())

Output result: Unnamed: 0 is no longer available

date open close high low volume code 0 2010-01-11 104.400 102.926 105.230 102.422 24461.03 600519 1 2010-01-12 103.028 105.708 106.040 102.492 31063.40 600519 2 2010-01-13 104.649 103.022 105.389 102.741 37924.44 600519 3 2010-01-14 103.379 107.552 107.974 103.379 46454.64 600519 4 2010-01-15 107.533 108.401 110.641 107.533 45938.50 600519

Converts the time of the string type of the date column to the time series type

#Converts the time of the string type of the date column to the time series type df["date"]=pd.to_datetime(df["date"]) print(df["date"].dtype)

Output result: the date column has become a time type

datetime64[ns]

Use the date column as the row index of the source data

#Use the date column as the row index of the source data

df.set_index("date",inplace=True)

print(df.head())Output result: the time column is used as the row index

open close high low volume code date 2010-01-11 104.400 102.926 105.230 102.422 24461.03 600519 2010-01-12 103.028 105.708 106.040 102.492 31063.40 600519 2010-01-13 104.649 103.022 105.389 102.741 37924.44 600519 2010-01-14 103.379 107.552 107.974 103.379 46454.64 600519 2010-01-15 107.533 108.401 110.641 107.533 45938.50 600519

Data analysis

1. Output all the dates when the closing price of the stock is more than 3% higher than the opening price.

(closing opening) / opening > 0.03

print((df['close']-df['open'])/df['open']>0.03)

Output results

date

2010-01-11 False

2010-01-12 False

2010-01-13 False

2010-01-14 True

2010-01-15 False

...

2021-11-16 FalseExperience: in df related operations, once the Boolean value is returned, the next step is to take the Boolean value as the row index of the original data

Obtain the line data meeting the demand (the closing price is more than 3% higher than the opening price)

# It is found that the Boolean value can be used as the row index of df, and the row data corresponding to true can be directly extracted df2=df.loc[(df['close'] - df['open']) / df['open'] > 0.03] print(df2.head())

Output result: only true rows are reserved

date 2010-01-14 103.379 107.552 107.974 103.379 46454.64 600519 2010-01-28 104.566 107.974 108.708 104.336 30267.52 600519 2010-04-21 91.573 94.458 94.579 90.431 63365.87 600519 2010-05-07 80.406 82.965 83.195 80.087 31254.76 600519 2010-05-21 82.576 85.645 85.894 81.982 27341.38 600519 Process finished with exit code 0

Get the date when the requirement is met

#Get the date when the requirement is met print(df2.index)

Output results

DatetimeIndex(['2010-01-14', '2010-01-28', '2010-04-21', '2010-05-07',

'2010-05-21', '2010-08-02', '2010-08-30', '2010-10-20',

'2010-11-10', '2010-11-23',

...

'2021-05-25', '2021-07-28', '2021-08-02', '2021-08-10',

'2021-08-24', '2021-09-01', '2021-09-17', '2021-09-24',

'2021-09-27', '2021-10-13'],

dtype='datetime64[ns]', name='date', length=172, freq=None)

Process finished with exit code 02. The date when the opening price of the stock is more than 2% lower than the closing price of the previous day.

- (opening closing the day before) / closing the day before < -0.02

- shift(n) You can move the column n rows as a whole. A positive number means moving down and a negative number means moving up

- df['close'].shift(1) represents the closing number of the previous day

#The date when the opening price of the stock is more than 2% lower than the closing price of the previous day df3=df.loc[(df['open'] - df['close'].shift(1))/ df['close'].shift(1)<- 0.02].index print(df3)

Output results

DatetimeIndex(['2010-04-26', '2010-04-30', '2011-08-05', '2012-03-27',

'2012-08-10', '2012-11-22', '2012-12-04', '2012-12-24',

'2013-01-16', '2013-01-25', '2013-09-02', '2014-04-25',

'2015-01-19', '2015-05-25', '2015-07-03', '2015-07-08',

'2015-07-13', '2015-08-24', '2015-09-02', '2015-09-15',

'2017-11-17', '2018-02-06', '2018-02-09', '2018-03-23',

'2018-03-28', '2018-07-11', '2018-10-11', '2018-10-24',

'2018-10-25', '2018-10-29', '2018-10-30', '2019-05-06',

'2019-05-08', '2019-10-16', '2020-01-02', '2020-02-03',

'2020-03-13', '2020-03-23', '2020-10-26', '2021-02-26',

'2021-03-04', '2021-04-28', '2021-08-20', '2021-11-01'],

dtype='datetime64[ns]', name='date', freq=None)

Process finished with exit code 03. If I buy one hand (100 stocks) on the first trading day of each month and sell all stocks on the last trading day of each year from January 1, 2010, how is my income so far?

- Buy stock

- On the first trading day of each month, buy primary stocks according to the opening price

- A complete year requires 12 purchases of 1200 stocks in 12 hands (100 stocks in one hand)

- Sell stock

- All stocks are sold on the last trading day of each year according to the opening price (12-31)

- A full year needs to sell 1200 shares

- Note: in 2020, this person can only buy 700 stocks and cannot sell them. However, when calculating the total return, the value of the remaining shares needs to be included

- How to calculate the remaining stock value:

- 700 * opening price on the buying day

- How to calculate the remaining stock value:

Take the data from 2010 to 2020

#Take the data from 2010 to 2020 new_df=df["2010":"2020"] #If the row index is time series data, the index value can be obtained in this way print(new_df)

Output results

open close high low volume code date 2010-01-11 104.400 102.926 105.230 102.422 24461.03 600519 2010-01-12 103.028 105.708 106.040 102.492 31063.40 600519 2010-01-13 104.649 103.022 105.389 102.741 37924.44 600519 2010-01-14 103.379 107.552 107.974 103.379 46454.64 600519 2010-01-15 107.533 108.401 110.641 107.533 45938.50 600519 ... ... ... ... ... ... ... 2020-12-25 1802.990 1830.000 1847.000 1800.000 23088.00 600519 2020-12-28 1826.600 1873.000 1888.800 1826.050 30080.00 600519 2020-12-29 1873.000 1867.000 1886.800 1855.000 22868.00 600519 2020-12-30 1870.000 1933.000 1933.000 1869.990 34452.00 600519 2020-12-31 1941.000 1998.000 1998.980 1939.000 38860.00 600519 [2663 rows x 6 columns] Process finished with exit code 0

resample of data

- M represents the month and is output on the last day of each month

# Take out and group all the monthly data from 2010 to 2020, and take out the first data of each month df_monthly=new_df.resample(rule="M").first() print(df_monthly)

Output results

#The following figure shows some data examples. date actually shows the first trading day of each month, which is caused by its internal bug

open close high low volume code

date

2010-01-31 104.400 102.926 105.230 102.422 24461.03 600519

2010-02-28 107.769 107.776 108.216 106.576 29655.94 600519

2010-03-31 106.219 106.085 106.857 105.925 21734.74 600519

2010-04-30 101.324 102.141 102.422 101.311 23980.83 600519

2010-05-31 81.676 82.091 82.678 80.974 23975.16 600519

... ... ... ... ... ... ...

2020-08-31 1686.880 1668.000 1696.580 1660.000 34661.00 600519

2020-09-30 1792.000 1801.980 1802.000 1775.010 31640.00 600519

2020-10-31 1692.000 1696.000 1706.420 1688.000 34240.00 600519

2020-11-30 1675.000 1674.010 1695.000 1672.000 21066.00 600519

2020-12-31 1726.000 1737.000 1738.990 1720.010 28196.00 600519

[132 rows x 6 columns]

Process finished with exit code 0Calculate the total cost of buying stocks

#Calculate the total cost of buying stocks cost=df_monthly["open"].sum()*100 print(cost)

resample of data

- A represents the year, and the last data of 2020 is removed

# All the annual data from 2010 to 2020 are taken out and grouped, and the last data of each year is taken out df_yearly=new_df.resample(rule="A").last()[0:-1] # Remove the last data in 2020 print(df_yearly)

Output results

open close high low volume code date 2010-12-31 117.103 118.469 118.701 116.620 46084.0 600519 2011-12-31 138.039 138.468 139.600 136.105 29460.0 600519 2012-12-31 155.208 152.087 156.292 150.144 51914.0 600519 2013-12-31 93.188 96.480 97.179 92.061 57546.0 600519 2014-12-31 157.642 161.056 161.379 157.132 46269.0 600519 2015-12-31 207.487 207.458 208.704 207.106 19673.0 600519 2016-12-31 317.239 324.563 325.670 317.239 34687.0 600519 2017-12-31 707.948 687.725 716.329 681.918 76038.0 600519 2018-12-31 563.300 590.010 596.400 560.000 63678.0 600519 2019-12-31 1183.000 1183.000 1188.000 1176.510 22588.0 600519 Process finished with exit code 0

How much is the income from selling stocks

#How much is the income from selling stocks

income=df_yearly['open'].sum()*1200

print("The total return on shares sold on the last day of each year is:{}".format(income))Output results

The total return on shares sold on the last day of each year is 4368184.8

Calculate the value of the remaining shares

#Calculate the value of the remaining shares

last=df['open'][-1]*700

print("2020 The proceeds from the sale of the remaining shares in the year are:{}".format(last))Output results

2020 The proceeds from the sale of the remaining shares in the year were 1294300.0

Calculate total income + last - cost

#Calculate total revenue print(income + last - cost)

The total code of the above 2 questions

# -*-coding:utf-8-*-

import pandas as pd

import tushare as ts

df = ts.get_k_data(code='600519',start='2010-01-10')

print(df.head())

#Store df's data locally

df.to_csv('./maotai.csv')

#Load external data into df: read_xxx()

df=pd.read_csv('./maotai.csv')

print(df.head())

#Delete Unnamed: 0 column

df.drop(labels="Unnamed: 0",axis=1,inplace=True)

print(df.head())

#Converts the time of the string type of the date column to the time series type

df["date"]=pd.to_datetime(df["date"])

print(df["date"].dtype)

#Use the date column as the row index of the source data

df.set_index("date",inplace=True)

print(df.head())

#Output all the dates when the closing price of the stock is more than 3% higher than the opening price

print((df['close']-df['open'])/df['open']>0.03)

# It is found that the Boolean value can be used as the row index of df, and the row data corresponding to true can be directly extracted

df2=df.loc[(df['close'] - df['open']) / df['open'] > 0.03]

print(df2.head())

#Get the date when the requirement is met

print(df2.index)

#The date when the opening price of the stock is more than 2% lower than the closing price of the previous day

df3=df.loc[(df['open'] - df['close'].shift(1))/ df['close'].shift(1)<- 0.02].index

print(df3)

#Take the data from 2010 to 2020

new_df=df["2010":"2020"] #If the row index is time series data, the index value can be obtained in this way

print(new_df)

# Take out and group all the monthly data from 2010 to 2020, and take out the first data of each month

df_monthly=new_df.resample(rule="M").first()

print(df_monthly)

#Calculate the total cost of buying stocks

cost=df_monthly["open"].sum()*100

print(cost)

# All the annual data from 2010 to 2020 are taken out and grouped, and the last data of each year is taken out

df_yearly=new_df.resample(rule="A").last()[0:-1] # Remove the last data in 2020

print(df_yearly)

#How much is the income from selling stocks

income=df_yearly['open'].sum()*1200

print("The total return on shares sold on the last day of each year is:{}".format(income))

#Calculate the value of the remaining shares

last=df['open'][-1]*700

print("2020 The proceeds from the sale of the remaining shares in the year are:{}".format(last))

#Calculate total revenue

print(income + last - cost)Demand: Double average strategy formulation

get data

- Use the tushare package to obtain the historical quotation data of a stock

- Calculate the 5-day moving average and 30 day moving average of the stock's historical data

- What is the moving average?

- For each trading day, you can calculate the moving average of the previous N days, and then connect these moving average values to form a line, which is called the N-day moving average. The common moving average line has indicators of 5 days, 10 days, 30 days, 60 days, 120 days and 240 days.

- 5-day and 10-day are the reference indicators for short-term operation, which are called daily moving average indicators;

- 30 day and 60 day are medium-term moving average indicators, called quarterly moving average indicators;

- The 120 day and 240 day are long-term moving average indicators, which are called annual moving average indicators.

- For each trading day, you can calculate the moving average of the previous N days, and then connect these moving average values to form a line, which is called the N-day moving average. The common moving average line has indicators of 5 days, 10 days, 30 days, 60 days, 120 days and 240 days.

- Calculation method of moving average: MA = (C1+C2+C3+...+Cn)/N C: closing price of a day n: moving average period (days)

- What is the moving average?

# -*-coding:utf-8-*-

import pandas as pd

import numpy as np

import matplotlib.pyplot as plt

from pandas import Series,DataFrame

import tushare as ts

df=ts.get_k_data(code='600519',start='1999-01-10') # get data

df.to_csv('./maotai2.csv') # Store data

df=pd.read_csv('./maotai2.csv') #Read data

df.drop(labels='Unnamed: 0',axis=1,inplace=True) #Delete Unnamed: 0 column

df['date']=pd.to_datetime(df['date']) # Time from string to time

df.set_index('date',inplace=True) # Set date as index

print(df.head())

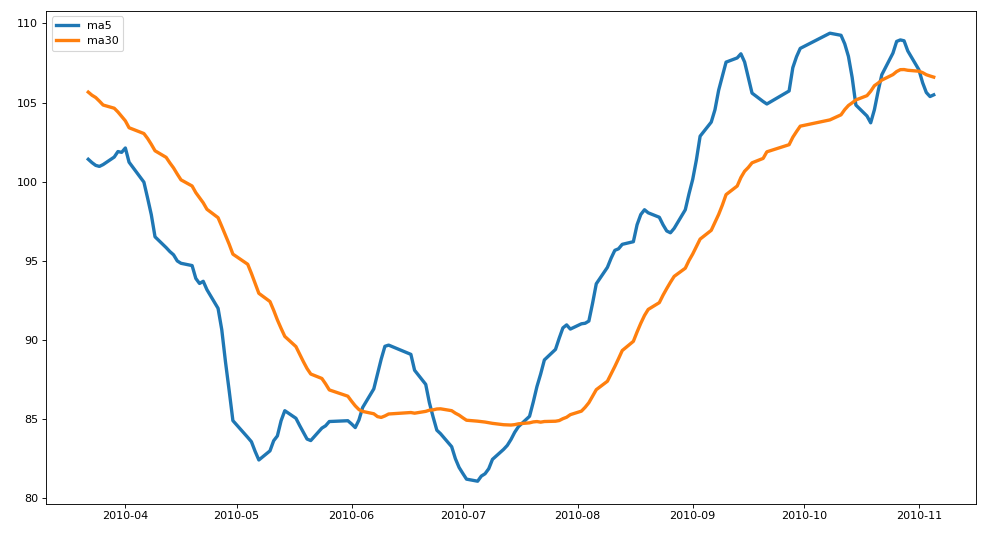

Calculate and develop a double moving average

rolling(5) gets the first five data of each data and counts itself

Average()

The first few data show NaN because there is not enough data in front of it

# -*-coding:utf-8-*-

import pandas as pd

import numpy as np

import matplotlib.pyplot as plt

from pandas import Series,DataFrame

import tushare as ts

df=ts.get_k_data(code='600519',start='1999-01-10') # get data

df.to_csv('./maotai2.csv') # Store data

df=pd.read_csv('./maotai2.csv') #Read data

df.drop(labels='Unnamed: 0',axis=1,inplace=True) #Delete Unnamed: 0 column

df['date']=pd.to_datetime(df['date']) # Time from string to time

df.set_index('date',inplace=True) # Set date as index

print(df.head())

#Calculate and develop a double moving average

df=df['2010':'2020']

ma5=df['close'].rolling(5).mean() #5-day moving average

ma30=df['close'].rolling(30).mean() #30 day moving average

#mapping

plt.figure(figsize=(15,8),dpi=80)

plt.plot(ma5[50:200],linewidth=3,label="ma5")

plt.plot(ma30[50:200],linewidth=3,label="ma30")

plt.legend() #Set legend style

plt.show()

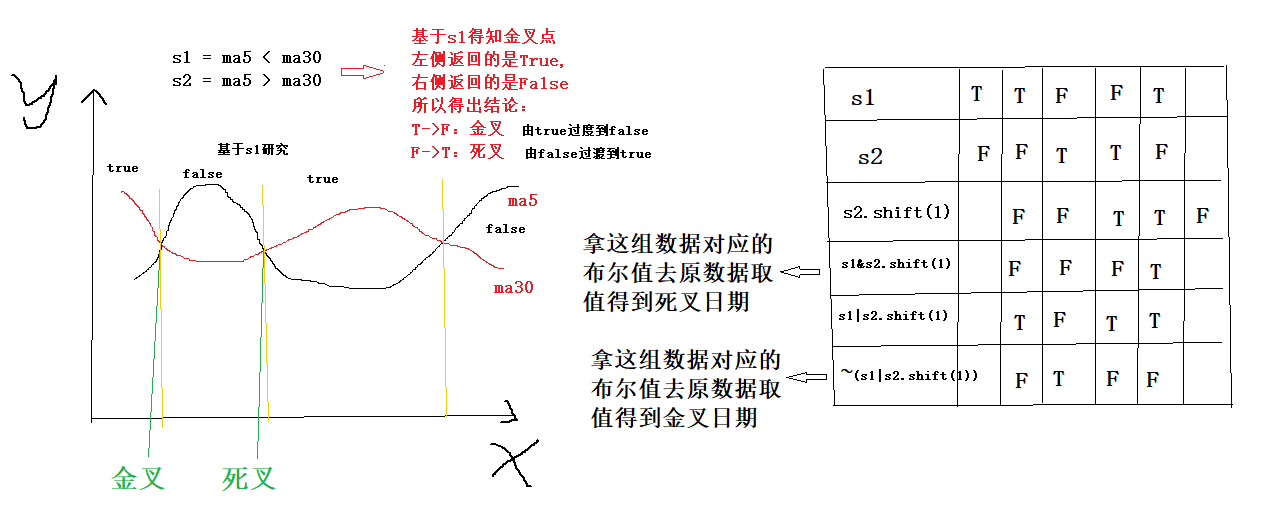

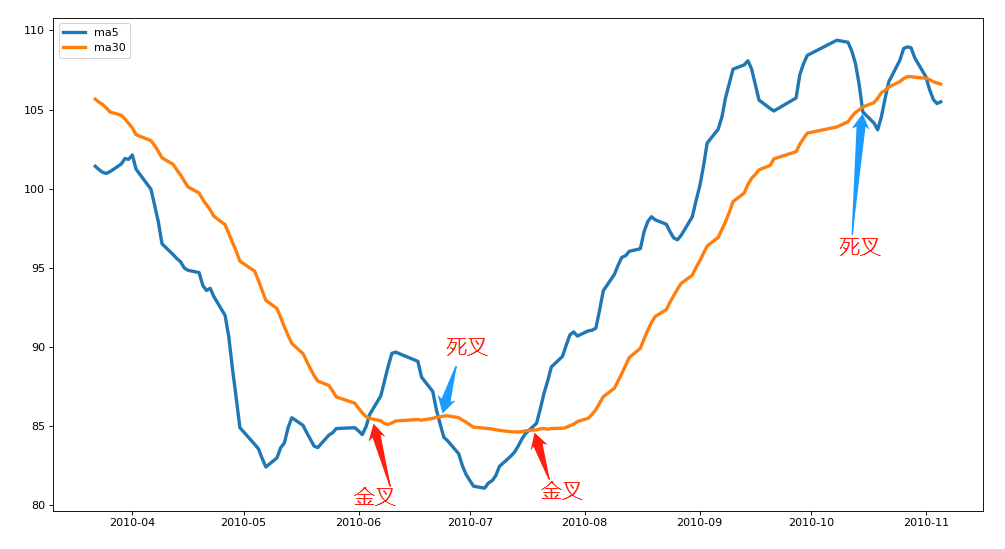

Analyze and output all golden cross dates and dead cross dates

Golden fork and dead fork in stock analysis technology

The golden fork and dead fork in stock analysis technology can be simply explained as follows:

- There are two lines in the analysis index, one is the index line in a short time, and the other is the index line in a long time.

- If the indicator line turns upward for a short time and crosses the indicator line for a long time, this state is called "golden fork";

- If the indicator line turns downward for a short time and crosses the indicator line for a long time, this state is called "dead fork";

- In general, after the occurrence of gold fork, the operation tends to buy; Dead forks tend to sell. Of course, golden fork and dead fork are only one of the analysis indicators. They should be used together with many other indicators to increase the accuracy of operation.

s1=ma5<ma30 kdj

s2=ma5>ma30 Dead fork

s1 and s2 are Boolean values

Data analysis

If I start from January 1, 2010, the initial capital is 100000 yuan, the golden fork tries to buy, and the dead fork sells all, what is my stock speculation yield so far?

- analysis:

- The unit price for buying and selling stocks shall be the opening price

- Timing of buying and selling stocks

- In the end, there will be surplus stocks that have not been sold

- There will be. If the last day is a golden fork, buy stocks. Estimate the value of the remaining shares and calculate the total income.

- The unit price of the remaining shares is the closing price on the last day.

- There will be. If the last day is a golden fork, buy stocks. Estimate the value of the remaining shares and calculate the total income.

Find out all the golden cross and dead cross dates of the time node

Analyze and output all golden cross dates and dead cross dates s1=ma5<ma30 print(s1) s2=ma5>ma30 print(s2) death_date=df.loc[s1&s2.shift(1)].index print(death_date) gold_date=df.loc[~(s1|s2.shift(1))].index print(gold_date)

Output results

DatetimeIndex(['2010-02-26', '2010-06-23', '2010-10-15', '2010-11-02',

'2010-12-24', '2011-03-02', '2011-03-30', '2011-09-08',

'2011-12-08', '2012-07-24', '2012-08-02', '2012-08-15',

'2012-09-21', '2012-11-07', '2012-12-25', '2013-01-18',

'2013-03-18', '2013-06-21', '2013-07-12', '2013-10-25',

'2013-11-26', '2013-12-04', '2014-04-01', '2014-04-30',

'2014-08-22', '2014-09-16', '2014-10-13', '2014-11-21',

'2015-01-19', '2015-06-17', '2015-07-17', '2015-09-28',

'2015-11-26', '2015-12-10', '2016-01-05', '2016-08-05',

'2016-08-18', '2016-11-21', '2017-07-06', '2017-09-08',

'2017-11-29', '2018-02-05', '2018-03-27', '2018-06-28',

'2018-07-23', '2018-07-31', '2018-10-15', '2018-12-25',

'2019-05-10', '2019-07-19', '2019-11-28', '2020-01-03',

'2020-02-28', '2020-03-18', '2020-08-10', '2020-09-21',

'2020-10-27'],

dtype='datetime64[ns]', name='date', freq=None)

DatetimeIndex(['2010-01-04', '2010-01-05', '2010-01-06', '2010-01-07',

'2010-01-08', '2010-01-11', '2010-01-12', '2010-01-13',

'2010-01-14', '2010-01-15', '2010-01-18', '2010-01-19',

'2010-01-20', '2010-01-21', '2010-01-22', '2010-01-25',

'2010-01-26', '2010-01-27', '2010-01-28', '2010-01-29',

'2010-02-01', '2010-02-02', '2010-02-03', '2010-02-04',

'2010-02-05', '2010-02-08', '2010-02-09', '2010-02-10',

'2010-02-11', '2010-02-12', '2010-06-04', '2010-07-19',

'2010-10-22', '2010-11-10', '2011-02-11', '2011-03-14',

'2011-04-28', '2011-10-25', '2012-02-10', '2012-07-25',

'2012-08-09', '2012-09-12', '2012-09-27', '2012-12-21',

'2013-01-10', '2013-03-12', '2013-04-17', '2013-07-03',

'2013-10-22', '2013-11-11', '2013-11-28', '2014-01-23',

'2014-04-03', '2014-06-23', '2014-09-04', '2014-09-29',

'2014-11-20', '2014-11-28', '2015-02-13', '2015-07-15',

'2015-09-16', '2015-10-09', '2015-12-03', '2015-12-21',

'2016-02-22', '2016-08-11', '2016-10-13', '2016-11-25',

'2017-07-24', '2017-09-18', '2017-12-15', '2018-03-16',

'2018-05-09', '2018-07-18', '2018-07-25', '2018-09-20',

'2018-12-04', '2019-01-03', '2019-06-14', '2019-08-13',

'2020-01-02', '2020-02-19', '2020-03-03', '2020-04-02',

'2020-08-19', '2020-10-14', '2020-11-05'],

dtype='datetime64[ns]', name='date', freq=None)

Process finished with exit code 0

Store the golden cross date and the dead cross date into two Series respectively, take the date as the index of the Series, and take 0 and 1 as the value of the Series

- The date corresponding to value 1 is the golden fork date

- The date corresponding to value 0 is a dead cross date

series_1 = Series(data=1, index=gold_date) #print(series_1) series_2 = Series(data=0, index=death_date) #print(series_2) # Cascade the golden cross and dead cross dates and sort them in ascending order according to the time index # Remove the data of the first 30 items, because these dates have continuous golden or dead cross dates series_all=series_1.append(series_2).sort_index()[30:] print(series_all)

Income calculation

- The golden fork shall buy as much as possible, and all the dead forks shall be sold. The unit price of buying and selling stocks shall use the opening price

- Special situation: yesterday was the golden fork. You can only buy but not sell. If you have any remaining stocks, you also need to calculate their value into the total income

#Income calculation

first_money = 100000 # Principal (immutable)

cost_money = 100000 # (variable)

hold = 0 # Number of shares held

for index in series_all.index:

# Index is series_ Display index of all

if series_all[index] == 1: # The day is a golden fork, and you need to buy stocks

# Find out the unit price of the stock

price = df['open'][index]

# Try to buy as many shares as you can with all your money

hand = cost_money // (price * 100)

hold = hand * 100 # How many stocks have you bought

# The money spent on buying stocks from cost_money minus

cost_money -= (hold * price)

else: # Sell stock

# Find the unit price of selling shares

price = df['open'][index]

cost_money += (price * hold)

hold = 0

# Calculate the actual value of the remaining shares (how to know if there are any remaining shares)

last_money = hold * df['open'][-1]

# Total revenue

print(last_money + cost_money - first_money)Output result: 2203311.1