Since the author does not have a deep mathematical background or financial knowledge, he will not quote various advanced investment models or mathematical models in this paper. The reference books are mainly "Turtle Trading Rules" and "Make a living from trading".

trading system

Before trading, we should first have a trading system to guide our own trading, there may not be any specifications, but it can be used as a basis for trading. As to whether this basis is not feasible, it is wise to be unscientific.

Of course, the trading system here is not necessarily a program, but refers to your own trading principles or some techniques or methods that you follow. You can execute them manually or with the help of a programming language, which is not a set of tools to use.

This refers to the trading system contained in the Turtle Dealing Rules (this refers only to the general direction).

To establish a perfect trading system, we should think about at least six aspects.

- 1. Market - what to buy and sell

- 2. Position size - how much to buy or sell

- 3. Market Entry - When to Buy

- 4. Stop Loss - When to Exit Lost Position

- 5. Stop Earnings - When to Exit Profitable Position

- 6. Departure - When to Departure

Simple examples

- Buy and sell A shares

- Full warehouse

- Buy more than 3% higher that day.

- Close positions when losses exceed 3%

- Day fall greater than 3% or three consecutive negative lines

Analysis: This trading strategy can only profit if the market is in a wavy upward shape, but in the case of consolidation, it is feared that it will suffer a lot.The reason why this is so simple and rude is to test the code simplicity for later strategies.

Data Acquisition and Processing

Because what is said here is to use python stock speculation, so we should use a program to obtain data. If artificial stock speculation, downloading any stock quotation software is possible, but manual execution requires more effort.

python is best known for its library of stock quotation data.

Here's an example of Eurovision stocks.

python environment installation

Install Anaconda (python version 2)

Download address: https://www.anaconda.com/download/

Note: If you have no experience installing this environment, Baidu or Google will do it. If you do not install anaconda, it will be difficult to solve the dependencies on your own.

If you are still confused in the world of programming, you can join us in Python learning to deduct qun:784758214 and see how our forefathers learned.Exchange experience.From basic Python scripts to web development, crawlers, django, data mining, and so on, zero-based to project actual data are organized.For every Python buddy!Share some learning methods and small details that need attention, Click to join us python learner cluster

Install tushare

pip install tushare

Reference resources: http://tushare.org/

Get Quote Data

import pandas as pd

import tushare as ts

# Get stock data by stock code, no start and end dates are specified here

df = ts.get_k_data("300104")

# View Top 10 Data

df.head()

# View the last ten pieces of data

df.tail()

# Converts the index of the data to the date corresponding to the date field

df.index = pd.to_datetime(df.date)

# Remove redundant date fields

df.drop("date", inplace=True, axis=1)Note: The relevant processing of stock data needs the knowledge of pandas,matplotlib. Reference: http://pandas.pydata.org/pandas-docs/version/0.20/10min.html

Calculate Common Indicators

# Calculate 5,15,50 day moving average, MA5, MA15, MA50

days = [5, 15, 50]

for ma in days:

column_name = "MA{}".format(ma)

df[column_name] = pd.rolling_mean(df.close, ma)

# Calculate floating ratio

df["pchange"] = df.close.pct_change()

# Calculate floating point numbers

df["change"] = df.close.diff()The results after final processing are as follows:

df.head()

Out[13]:

open close high low volume code MA5 MA15 MA50 \

date

2013-11-29 9.396 9.741 9.870 9.389 146587.0 300104 NaN NaN NaN

2013-12-02 9.298 8.768 9.344 8.768 177127.0 300104 NaN NaN NaN

2013-12-03 8.142 8.414 8.546 7.890 176305.0 300104 NaN NaN NaN

2013-12-04 8.391 8.072 8.607 8.053 120115.0 300104 NaN NaN NaN

2013-12-05 7.983 7.366 8.108 7.280 253764.0 300104 8.4722 NaN NaN

pchange change

date

2013-11-29 NaN NaN

2013-12-02 -0.099887 -0.973

2013-12-03 -0.040374 -0.354

2013-12-04 -0.040647 -0.342 visualization

Trend chart

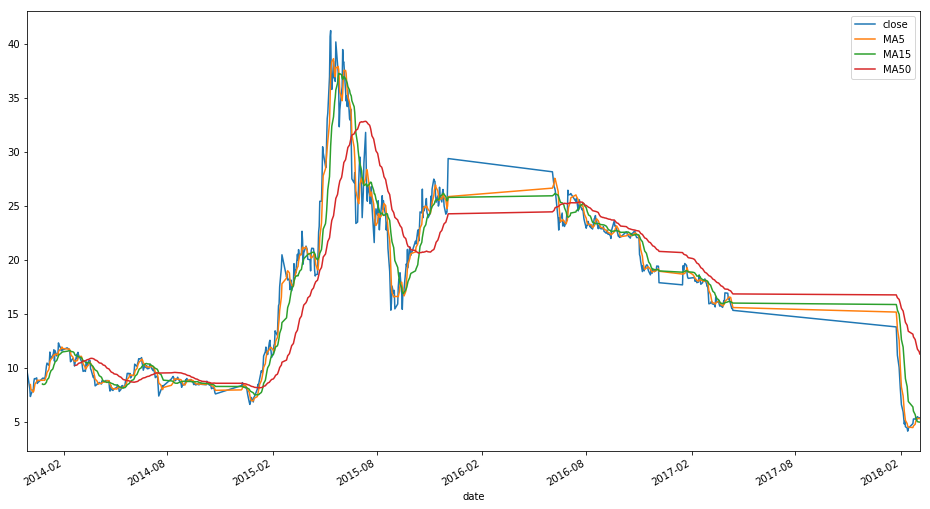

By visualizing the data, you can intuitively feel the trend of the stock market.

Personally, if using the program to speculate in stocks or everything should be quantified, there should not be too many subjective opinions, if too dependent on intuition or mood at that time, then there is really no need to use the program to analyze.

df[["close", "MA5", "MA15", "MA50"]].plot(figsiz=(10,18))

The results are as follows:

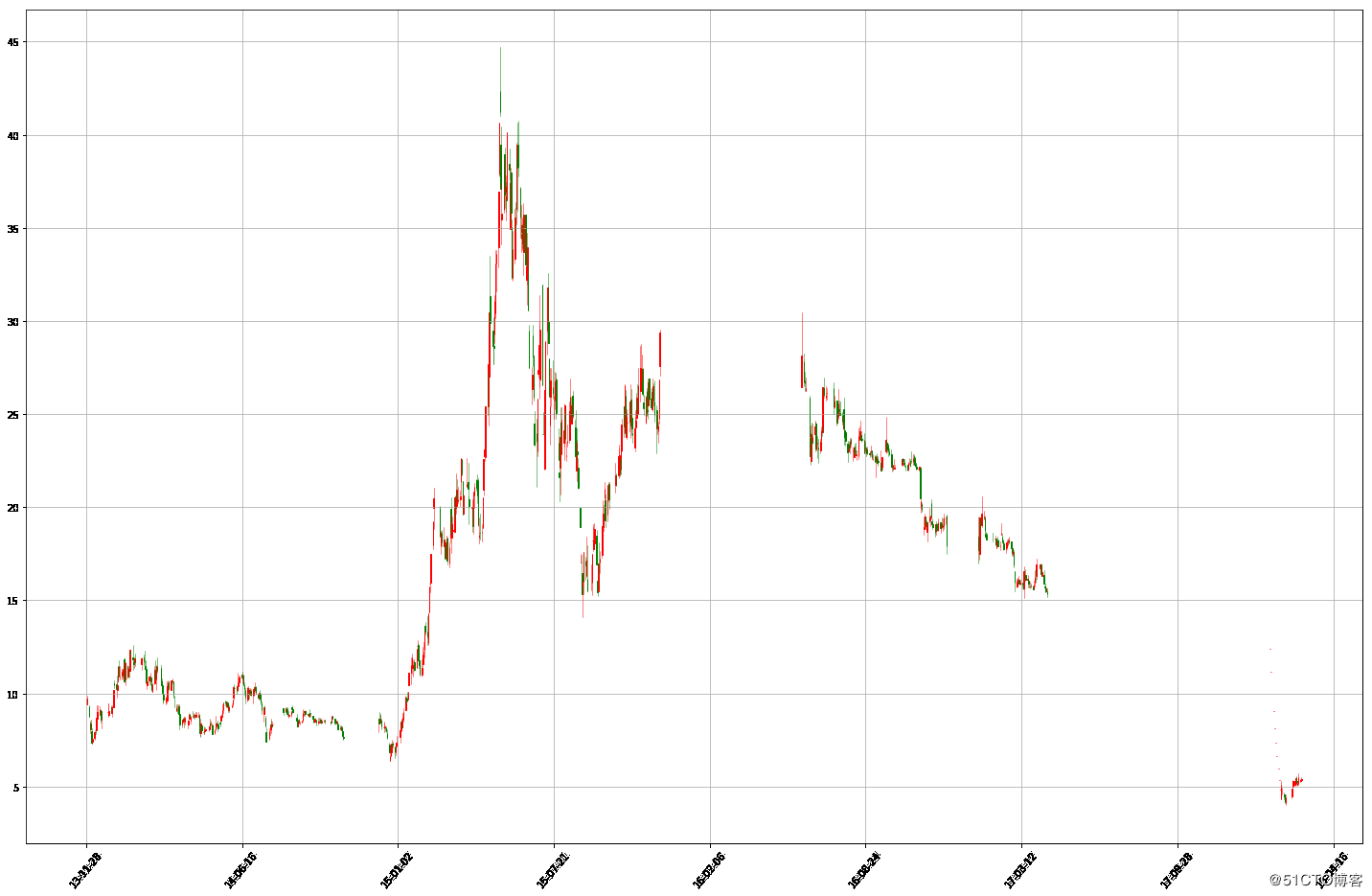

k-line graph

import matplotplib.pyplot as plt

from matplotlib.daet import DateFormatter

from matplotlib.finance import date2num, candlestick_ohlc

def candlePlot(data, title=""):

data["date"] = [date2num(pd.to_datetime(x)) for x in data.index]

dataList = [tuple(x) for x in data[

["date", "open", "high", "low", "close"]].values]

ax = plt.subplot()

ax.set_title(title)

ax.xaxis.set_major_formatter(DateFormatter("%y-%m-%d"))

candlestick_ohlc(ax, dataList, width=0.7, colorup="r", colordown="g")

plt.setp(plt.gca().get_xticklabels(), rotation=50,

horizontalalignment="center")

fig = plt.gcf()

fig.set_size_inches(20, 15)

plt.grid(True)

candlePlot(df)The results are as follows:

Note: This is just an example of the power and power of matplotlib. Check api or google if you encounter any strange problems.

Policy testing

Manual code

Use one of the recently purchased stocks here, Beijing East A(000725).

# Import related modules

import tushare as ts

import pandas as pd

# get data

df = ts.get_k_data("000725")

# Processing data

df.index = pd.to_datetime(df.date)

df.drop("date", axis=1, inplace=True)

# Calculate floating ratio

df["pchange"] = df.close.pct_change()

# Calculate floating point numbers

df["change"] = df.close.diff()

# View the first five rows of current data

open close high low volume code pchange change

date

2015-07-20 4.264 4.234 4.342 4.165 13036186.0 000725 NaN NaN

2015-07-21 4.136 4.195 4.274 4.096 8776773.0 000725 -0.009211 -0.039

2015-07-22 4.175 4.146 4.214 4.067 9083703.0 000725 -0.011681 -0.049

2015-07-23 4.136 4.254 4.283 4.096 12792734.0 000725 0.026049 0.108

2015-07-24 4.224 4.136 4.254 4.106 13009620.0 000725 -0.027739 -0.118

# Set recall value

withdraw = 0.03

# Set breakthrough value

breakthrough = 0.03

# Set up account funds

account = 10000

# Number of hands holding positions

position = 0

def buy(bar):

global account, position

print("{}: buy {}".format(bar.date, bar.close))

# Price at hand

one = bar.close * 100

position = account // one

account = account - (position * one)

def sell(bar):

global account, position

# Price at hand

print("{}: sell {}".format(bar.date, bar.close))

one = bar.close * 100

account += position * one

position = 0

print("Start time investment time: ", df.iloc[0].date)

for date in df.index:

bar = df.loc[date]

if bar.pchange and bar.pchange > breakthrough and position == 0:

buy(bar)

elif bar.pchange and bar.pchange < withdraw and position > 0:

sell(bar)

print("Cash eventually available: ", account)

print("Final market capitalization: ", position * df.iloc[-1].close * 100)The output is as follows:

Start time investment time: 2015-07-20 2015-07-29: buy 3.83 2015-07-30: sell 3.653 2015-08-04: buy 3.752 ...... 2018-02-27: sell 5.71 2018-03-06: buy 5.79 Final cash available: 333.3 Final market value: 7527.0

CONCLUSION: More than 2,000 dollars have been lost through the above tests.

With Test Framework

With the help of the test frame, the correct withdrawal position is achieved, because the frame contains more functions.pyalgotrade is used here.

Simple use

from pyalgotrade import strategy

from pyalgotrade import technical

from pyalgotrade.barfeed import yahoofeed

# Custom Event Window Class

class DiffEventWindow(technical.EventWindow):

def __init__(self, period):

assert(period > 0)

super(DiffEventWindow, self).__init__(period)

self.__value = None

def onNewValue(self, dateTime, value):

super(DiffEventWindow, self).onNewValue(dateTime, value)

if self.windowFull():

lastValue = self.getValues()[0]

nowValue = self.getValues()[1]

self.__value = (nowValue - lastValue) / lastValue

def getValue(self):

return self.__value

# Custom Indicators

class Diff(technical.EventBasedFilter):

def __init__(self, dataSeries, period, maxLen=None):

super(Diff, self).__init__(dataSeries, DiffEventWindow(period), maxLen)

# Define your own strategy

class MyStrategy(strategy.BacktestingStrategy):

def __init__(self, feed, instrument, diffPeriod=2):

# Incoming feed and initial account funds

super(MyStrategy, self).__init__(feed, 10000)

self.__instrument = instrument

self.__position = None

self.setUseAdjustedValues(True)

self.__prices = feed[instrument].getPriceDataSeries()

self.__diff = Diff(self.__prices, diffPeriod)

self.__break = 0.03

self.__withdown = -0.03

def getDiff(self):

return self.__diff

def onEnterCanceled(self, position):

self.__position = None

def onEnterOk(self, position):

execInfo = position.getEntryOrder().getExecutionInfo()

self.info("BUY at $%.2f" % (execInfo.getPrice()))

def onExitOk(self, position):

execInfo = position.getExitOrder().getExecutionInfo()

self.info("SELL at $%.2f" % (execInfo.getPrice()))

self.__position = None

def onExitCanceled(self, position):

# If the exit was canceled, re-submit it.

self.__position.exitMarket()

def onBars(self, bars):

account = self.getBroker().getCash()

bar = bars[self.__instrument]

if self.__position is None:

one = bar.getPrice() * 100

oneUnit = account // one

if oneUnit > 0 and self.__diff[-1] > self.__break:

self.__position = self.enterLong(self.__instrument, oneUnit * 100, True)

elif self.__diff[-1] < self.__withdown and not self.__position.exitActive():

self.__position.exitMarket()

def runStrategy():

# Download Data

jdf = ts.get_k_data("000725")

# New Adj Close Field

jdf["Adj Close"] =jdf.close

# Save fields of data under tushare in the data format required by pyalgotrade

jdf.columns = ["Date", "Open", "Close", "High", "Low", "Volume", "code", "Adj Close"]

# Save data to a cost-effective csv file

jdf.to_csv("jdf.csv", index=False)

feed = yahoofeed.Feed()

feed.addBarsFromCSV("jdf", "jdf.csv")

myStrategy = MyStrategy(feed, "jdf")

myStrategy.run()

print("Final portfolio value: $%.2f" % myStrategy.getResult())

runStrategy()

The output is as follows

2015-07-30 00:00:00 strategy [INFO] BUY at $3.78 2015-07-31 00:00:00 strategy [INFO] SELL at $3.57 2015-08-05 00:00:00 strategy [INFO] BUY at $3.73 2015-08-06 00:00:00 strategy [INFO] SELL at $3.56 ... 2018-02-13 00:00:00 strategy [INFO] BUY at $5.45 Final portfolio value: $7877.30

At a glance, you'll see that you seem to have written more code with the framework, but it has more analysis tools built into it.

Here is a brief description.

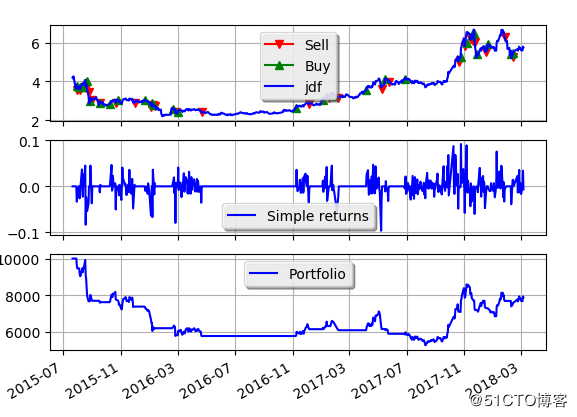

Policy Visualization

from pyalgotrade import strategy

from pyalgotrade import technical

from pyalgotrade.barfeed import yahoofeed

from pyalgotrade import plotter

from pyalgotrade.stratanalyzer import returns

class DiffEventWindow(technical.EventWindow):

def __init__(self, period):

assert(period > 0)

super(DiffEventWindow, self).__init__(period)

self.__value = None

def onNewValue(self, dateTime, value):

super(DiffEventWindow, self).onNewValue(dateTime, value)

if self.windowFull():

lastValue = self.getValues()[0]

nowValue = self.getValues()[1]

self.__value = (nowValue - lastValue) / lastValue

def getValue(self):

return self.__value

class Diff(technical.EventBasedFilter):

def __init__(self, dataSeries, period, maxLen=None):

super(Diff, self).__init__(dataSeries, DiffEventWindow(period), maxLen)

class MyStrategy(strategy.BacktestingStrategy):

def __init__(self, feed, instrument, diffPeriod=2):

super(MyStrategy, self).__init__(feed, 10000)

self.__instrument = instrument

self.__position = None

self.setUseAdjustedValues(True)

self.__prices = feed[instrument].getPriceDataSeries()

self.__diff = Diff(self.__prices, diffPeriod)

self.__break = 0.03

self.__withdown = -0.03

def getDiff(self):

return self.__diff

def onEnterCanceled(self, position):

self.__position = None

def onEnterOk(self, position):

execInfo = position.getEntryOrder().getExecutionInfo()

self.info("BUY at $%.2f" % (execInfo.getPrice()))

def onExitOk(self, position):

execInfo = position.getExitOrder().getExecutionInfo()

self.info("SELL at $%.2f" % (execInfo.getPrice()))

self.__position = None

def onExitCanceled(self, position):

# If the exit was canceled, re-submit it.

self.__position.exitMarket()

def onBars(self, bars):

account = self.getBroker().getCash()

bar = bars[self.__instrument]

if self.__position is None:

one = bar.getPrice() * 100

oneUnit = account // one

if oneUnit > 0 and self.__diff[-1] > self.__break:

self.__position = self.enterLong(self.__instrument, oneUnit * 100, True)

elif self.__diff[-1] < self.__withdown and not self.__position.exitActive():

self.__position.exitMarket()

def runStrategy():

# Download Data

jdf = ts.get_k_data("000725")

# New Adj Close Field

jdf["Adj Close"] =jdf.close

# Save fields of data under tushare in the data format required by pyalgotrade

jdf.columns = ["Date", "Open", "Close", "High", "Low", "Volume", "code", "Adj Close"]

# Save data to a cost-effective csv file

jdf.to_csv("jdf.csv", index=False)

feed = yahoofeed.Feed()

feed.addBarsFromCSV("jdf", "jdf.csv")

myStrategy = MyStrategy(feed, "jdf")

returnsAnalyzer = returns.Returns()

myStrategy.attachAnalyzer(returnsAnalyzer)

plt = plotter.StrategyPlotter(myStrategy)

plt.getInstrumentSubplot("jdf")

plt.getOrCreateSubplot("returns").addDataSeries("Simple returns", returnsAnalyzer.getReturns())

myStrategy.run()

print("Final portfolio value: $%.2f" % myStrategy.getResult())

plt.plot()

runStrategy()

Python Resource Sharing qun 784758214 ,Installation packages are included. PDF,Learn video, here is Python The place where learners gather, zero base, advanced, all welcomeThe picture output is as follows

Note: The strategy test stock selection and time selection here are not rigorous, only for function demonstration, the test results may have great coincidence.

Stock price monitoring

According to this requirement, a semi-finished product for stock price monitoring is written, which is monitored by mailbox.

Tip: Enable QQ mailbox alert in WeChat's accessibility function, then stock price change notification will be timely, because WeChat is almost equivalent to text messages.

Here is a brief description of each configuration item and how to use it.

default paragraph

Breathrough represents the proportion of breakthroughs that need to be passed in two values. The breakthrough proportions within a project are 3% and 5%, respectively.

Withdraw represents a withdraw and also requires two values, 3% and 5% for example.

attention represents a list of stocks of interest, filled in stock codes of interest, separated by spaces

Note: There is no concern about stocks at this time, so a lot of attention to stocks may have performance problems.

mail Paragraph

Enter the username and password in turn and the recipient's mailbox

Positionon Paragraph

Stocks currently held and their holding costs.

If you hold Beijing East A(000725) at a stock price of 5.76.

000725 = 5.76

If there are multiple positions, there are corresponding key-value pairs as above.

Use method to refer to the readme of the script

https://github.com/youerning/UserPyScript/blob/master/monitor/README.md

==PS: Unfortunately the English level is not good, but also because of the comments, as well as the use of English vocabulary as variable names, if the words do not agree, please forgive me.==

Place an order

This part of me did not let the program execute automatically for the time being, because we have not developed a suitable and trusted system yet, so we rely on the notification of stock price monitoring to execute transactions manually according to the constantly revised system.

Postnote

Since it has been in the market for less than a year, you don't need to ask me about my trends or earnings. Current results are 5 games, 3 wins, slim profits.

Finally, end with the following figure.

Last but not least:

Watch and go again