MyTT

MyTT is a Swiss Army knife in your quantitative toolbox. It is refined and efficient. It simply transplants the indicator formula indicators such as tongdaxin, tonghuashun, Mandarin Chinese and wheat language into Python. The core library is a single file with only 100 lines of code. It implements and converts all common indicators of tonghuashun tongdaxin, such as MACD, RSI, BOL, ATR, KDJ, CCI, Psy, etc. all based on function encapsulation of numpy and pandas, which is simple and high-performance, It can be easily applied in the fields of stock market technical analysis, automatic programmed trading of stocks, quantification of digital currency BTC and so on

Functional features

-

Core library lightweight: the project library is just a file MyTT Py, no installation, no setting, just use and go (from MyTT import *)

-

Code Humanization:) there are no conspicuous programming tricks. Beginners can understand them. They can increase their own indicators and use them in the project immediately.

-

There is no need to install TA lib library, which is the core logic implemented by pure python code. Many people have the painful experience of installing TA lib library

-

It is completely compatible with the index writing method of tongdaxin and tonghuashun. A new index can be used directly without modification

-

Ultra high performance, basically no loop, all rely on the built-in functions of numpy and pandas to achieve various indicators

-

Like the Talib library, it is multi-day parameter input and multi-day indicator (sequence input and sequence output), which is convenient for drawing and observing trends

-

Various indexes realized by MyTT are consistent with the technical indexes of tongdaxin, flush, snowball and other software to 2 decimal places

Let's start with the simplest example

#Stock market data acquisition and mapping-2

from Ashare import * #Stock database https://github.com/mpquant/Ashare

from MyTT import * #myTT language tool function index library https://github.com/mpquant/MyTT

# Securities codes are compatible with a variety of formats, tongdaxin, flush, jukuan

# sh000001 (000001.XSHG) sz399006 (399006.XSHE) sh600519 ( 600519.XSHG )

df=get_price('000001.XSHG',frequency='1d',count=120) #Get the daily real-time market for the first 120 days today

print('Shanghai Stock Index daily market\n',df.tail(5))

#-------With the data, let's get to the point-------------

CLOSE=df.close.values; OPEN=df.open.values #The basic data definition can be used as long as the sequence is passed in

HIGH=df.high.values; LOW=df.low.values #For example, CLOSE=list(df.close) is the same

MA5=MA(CLOSE,5) #Get the 5-day moving average sequence

MA10=MA(CLOSE,10) #Get the 10 day moving average sequence

up,mid,lower=BOLL(CLOSE) #Obtain Bollinger belt index data

print('BTC5 Daily average', MA5[-1] ) # Take only the last number

print('BTC10 Daily average',RET(MA10)) # RET(MA10) == MA10[-1]

print('Do you wear the 10th line on the 5th line today',RET(CROSS(MA5,MA10)))

print('Are the closing prices of the last five days all greater than the 10 day line?',EVERY(CLOSE>MA10,5) )

#Shanghai Stock Index daily market----------------------------------------------------

open close high low volume

2021-06-07 3597.14 3599.54 3600.38 3581.90 303718677.0

2021-06-08 3598.75 3580.11 3621.52 3563.25 304491470.0

2021-06-09 3576.80 3591.40 3598.71 3572.64 298323296.0

2021-06-10 3587.53 3610.86 3624.34 3584.13 318174808.0

2021-06-11 3614.11 3589.75 3614.40 3587.15 360554970.0

#Guizhou Maotai 60 minute line----------------------------------------------------

open close high low volume

2021-06-10 14:00:00 2237.00 2224.16 2245.00 2222.00 4541.53

2021-06-10 15:00:00 2222.21 2238.48 2240.34 2222.21 4146.88

2021-06-11 10:30:00 2239.00 2220.00 2244.00 2197.86 12030.00

2021-06-11 11:30:00 2220.01 2210.18 2231.80 2200.18 4868.00

2021-06-11 14:00:00 2210.10 2223.35 2224.48 2206.01 4544.00

2021-06-11 15:00:00 2223.33 2178.81 2226.80 2178.81 12529.00

Some tool functions in MyTT Library

#------------------Level 0: core tool functions--------------------------------------------

def RD(N,D=3): return np.round(N,D) #Rounded to 3 decimal places

def RET(S,N=1): return np.array(S)[-N] #Returns the penultimate value of the sequence. The last value is returned by default

def ABS(S): return np.abs(S) #Returns the absolute value of N

def MAX(S1,S2): return np.maximum(S1,S2) #Sequence max

def MIN(S1,S2): return np.minimum(S1,S2) #Sequence min

def MA(S,N): #Find the N-day average of the sequence and return the sequence

return pd.Series(S).rolling(N).mean().values # pd.rolling_mean(S,N) (Python2)

def REF(S, N=1): #Move N down the sequence as a whole and return the sequence (Nan will be generated after shift)

return pd.Series(S).shift(N).values

def DIFF(S, N=1): #If the previous value is subtracted from the next value, nan will be generated in front

return pd.Series(S).diff(N) #np.diff(S) delete nan directly, and one line will be lost

def STD(S,N): #Find the N-day standard deviation of the sequence and return the sequence

return pd.Series(S).rolling(N).std(ddof=0).values

def IF(S_BOOL,S_TRUE,S_FALSE): #Sequence Boolean judgment res=S_TRUE if S_BOOL==True else S_FALSE

return np.where(S_BOOL, S_TRUE, S_FALSE)

def SUM(S, N): #Calculate the N-day cumulative sum of the sequence, return the sequence N=0, and sum all the sequences in turn

return pd.Series(S).rolling(N).sum().values if N>0 else pd.Series(S).cumsum() #pd.rolling_sum(S,N) (Python2)

def HHV(S,N): # HHV(C, 5) # Highest closing price in the last five days

return pd.Series(S).rolling(N).max().values # pd.rolling_max(S,N) (Python2)

def LLV(S,N): # LLV(C, 5) # Lowest closing price in the last five days

return pd.Series(S).rolling(N).min().values # pd.rolling_min(S,N) (Python2)

def EMA(S,N): #Exponential moving average, in order to achieve accuracy s > 4 * n, EMA needs at least 120 cycles

return pd.Series(S).ewm(span=N, adjust=False).mean().values

def SMA(S, N, M=1): #Chinese SMA requires at least 120 cycles to be accurate

K = pd.Series(S).rolling(N).mean() #Find the average value first (please let us know if there is a way to improve the performance without cycling)

for i in range(N+1, len(S)): K[i] = (M * S[i] + (N -M) * K[i-1]) / N # Because we want to take K[i-1], range(N+1, len(S))

return K

def AVEDEV(S,N): #Mean absolute deviation (the average of the absolute difference between the sequence and its mean)

avedev=pd.Series(S).rolling(N).apply(lambda x: (np.abs(x - x.mean())).mean())

return avedev.values

def SLOPE(S,N,RS=False): #Return the slope of linear regression for N cycles of S sequence (only the slope is returned by default, not the whole linear sequence)

M=pd.Series(S[-N:]); poly = np.polyfit(M.index, M.values,deg=1); Y=np.polyval(poly, M.index);

if RS: return Y[1]-Y[0],Y

return Y[1]-Y[0]

The realized technical indicators basically cover the vast majority of commonly used indicators

#------------------Level 2: technical index function (all realized through level 0 and level 1 functions)------------------------------

def MACD(CLOSE,SHORT=12,LONG=26,M=9): # For the relationship between EMA, S takes 120 days, which is the same as the two decimal places of snowball

DIF = EMA(CLOSE,SHORT)-EMA(CLOSE,LONG);

DEA = EMA(DIF,M); MACD=(DIF-DEA)*2

return RD(DIF),RD(DEA),RD(MACD)

def KDJ(CLOSE,HIGH,LOW, N=9,M1=3,M2=3): # KDJ index

RSV = (CLOSE - LLV(LOW, N)) / (HHV(HIGH, N) - LLV(LOW, N)) * 100

K = EMA(RSV, (M1*2-1)); D = EMA(K,(M2*2-1)); J=K*3-D*2

return K, D, J

def RSI(CLOSE, N=24):

DIF = CLOSE-REF(CLOSE,1)

return RD(SMA(MAX(DIF,0), N) / SMA(ABS(DIF), N) * 100)

def WR(CLOSE, HIGH, LOW, N=10, N1=6): #W & R indicators

WR = (HHV(HIGH, N) - CLOSE) / (HHV(HIGH, N) - LLV(LOW, N)) * 100

WR1 = (HHV(HIGH, N1) - CLOSE) / (HHV(HIGH, N1) - LLV(LOW, N1)) * 100

return RD(WR), RD(WR1)

def BIAS(CLOSE,L1=6, L2=12, L3=24): # BIAS deviation rate

BIAS1 = (CLOSE - MA(CLOSE, L1)) / MA(CLOSE, L1) * 100

BIAS2 = (CLOSE - MA(CLOSE, L2)) / MA(CLOSE, L2) * 100

BIAS3 = (CLOSE - MA(CLOSE, L3)) / MA(CLOSE, L3) * 100

return RD(BIAS1), RD(BIAS2), RD(BIAS3)

def BOLL(CLOSE,N=20, P=2): #BOLL index, brin zone

MID = MA(CLOSE, N);

UPPER = MID + STD(CLOSE, N) * P

LOWER = MID - STD(CLOSE, N) * P

return RD(UPPER), RD(MID), RD(LOWER)

def PSY(CLOSE,N=12, M=6):

PSY=COUNT(CLOSE>REF(CLOSE,1),N)/N*100

PSYMA=MA(PSY,M)

return RD(PSY),RD(PSYMA)

def CCI(CLOSE,HIGH,LOW,N=14):

TP=(HIGH+LOW+CLOSE)/3

return (TP-MA(TP,N))/(0.015*AVEDEV(TP,N))

def ATR(CLOSE,HIGH,LOW, N=20): #Daily average of real fluctuation N

TR = MAX(MAX((HIGH - LOW), ABS(REF(CLOSE, 1) - HIGH)), ABS(REF(CLOSE, 1) - LOW))

return MA(TR, N)

def BBI(CLOSE,M1=3,M2=6,M3=12,M4=20): #BBI long and short index

return (MA(CLOSE,M1)+MA(CLOSE,M2)+MA(CLOSE,M3)+MA(CLOSE,M4))/4

def DMI(CLOSE,HIGH,LOW,M1=14,M2=6): #Trend indicators: the results are completely consistent with flush and tongdaxin

TR = SUM(MAX(MAX(HIGH - LOW, ABS(HIGH - REF(CLOSE, 1))), ABS(LOW - REF(CLOSE, 1))), M1)

HD = HIGH - REF(HIGH, 1); LD = REF(LOW, 1) - LOW

DMP = SUM(IF((HD > 0) & (HD > LD), HD, 0), M1)

DMM = SUM(IF((LD > 0) & (LD > HD), LD, 0), M1)

PDI = DMP * 100 / TR; MDI = DMM * 100 / TR

ADX = MA(ABS(MDI - PDI) / (PDI + MDI) * 100, M2)

ADXR = (ADX + REF(ADX, M2)) / 2

return PDI, MDI, ADX, ADXR

def TAQ(HIGH,LOW,N): #Tang Anqi channel (turtle) trading index, the avenue to Jane, can cross cattle and bears

UP=HHV(HIGH,N); DOWN=LLV(LOW,N); MID=(UP+DOWN)/2

return UP,MID,DOWN

def KTN(CLOSE,HIGH,LOW,N=20,M=10): #Kentner trading channel, N chooses 20 days and ATR chooses 10 days

MID=EMA((HIGH+LOW+CLOSE)/3,N)

ATRN=ATR(CLOSE,HIGH,LOW,M)

UPPER=MID+2*ATRN; LOWER=MID-2*ATRN

return UPPER,MID,LOWER

def TRIX(CLOSE,M1=12, M2=20): #Triple exponential smoothing average

TR = EMA(EMA(EMA(CLOSE, M1), M1), M1)

TRIX = (TR - REF(TR, 1)) / REF(TR, 1) * 100

TRMA = MA(TRIX, M2)

return TRIX, TRMA

def VR(CLOSE,VOL,M1=26): #VR capacity ratio

LC = REF(CLOSE, 1)

return SUM(IF(CLOSE > LC, VOL, 0), M1) / SUM(IF(CLOSE <= LC, VOL, 0), M1) * 100

def EMV(HIGH,LOW,VOL,N=14,M=9): #Simple fluctuation index

VOLUME=MA(VOL,N)/VOL; MID=100*(HIGH+LOW-REF(HIGH+LOW,1))/(HIGH+LOW)

EMV=MA(MID*VOLUME*(HIGH-LOW)/MA(HIGH-LOW,N),N); MAEMV=MA(EMV,M)

return EMV,MAEMV

def DPO(CLOSE,M1=20, M2=10, M3=6): #Interval Oscillation line

DPO = CLOSE - REF(MA(CLOSE, M1), M2); MADPO = MA(DPO, M3)

return DPO, MADPO

def BRAR(OPEN,CLOSE,HIGH,LOW,M1=26): #BRAR-ARBR emotional indicators

AR = SUM(HIGH - OPEN, M1) / SUM(OPEN - LOW, M1) * 100

BR = SUM(MAX(0, HIGH - REF(CLOSE, 1)), M1) / SUM(MAX(0, REF(CLOSE, 1) - LOW), M1) * 100

return AR, BR

def DMA(CLOSE,N1=10,N2=50,M=10): #Parallel line difference index

DIF=MA(CLOSE,N1)-MA(CLOSE,N2); DIFMA=MA(DIF,M)

return DIF,DIFMA

def MTM(CLOSE,N=12,M=6): #Momentum index

MTM=CLOSE-REF(CLOSE,N); MTMMA=MA(MTM,M)

return MTM,MTMMA

def MASS(HIGH,LOW,N1=9,N2=25,M=6): # Mace line

MASS=SUM(MA(HIGH-LOW,N1)/MA(MA(HIGH-LOW,N1),N1),N2)

MA_MASS=MA(MASS,M)

return MASS,MA_MASS

def ROC(CLOSE,N=12,M=6): #Rate of change index

ROC=100*(CLOSE-REF(CLOSE,N))/REF(CLOSE,N); MAROC=MA(ROC,M)

return ROC,MAROC

def EXPMA(CLOSE,N1=12,N2=50): #EMA index average index

return EMA(CLOSE,N1),EMA(CLOSE,N2);

def OBV(CLOSE,VOL): #Energy tide index

return SUM(IF(CLOSE>REF(CLOSE,1),VOL,IF(CLOSE<REF(CLOSE,1),-VOL,0)),0)/10000

def ASI(OPEN,CLOSE,HIGH,LOW,M1=26,M2=10): #Vibration lifting index

LC=REF(CLOSE,1); AA=ABS(HIGH-LC); BB=ABS(LOW-LC);

CC=ABS(HIGH-REF(LOW,1)); DD=ABS(LC-REF(OPEN,1));

R=IF( (AA>BB) & (AA>CC),AA+BB/2+DD/4,IF( (BB>CC) & (BB>AA),BB+AA/2+DD/4,CC+DD/4));

X=(CLOSE-LC+(CLOSE-OPEN)/2+LC-REF(OPEN,1));

SI=16*X/R*MAX(AA,BB); ASI=SUM(SI,M1); ASIT=MA(ASI,M2);

return ASI,ASIT

#I hope you can submit more indicators and functions https://github.com/mpquant/MyTT

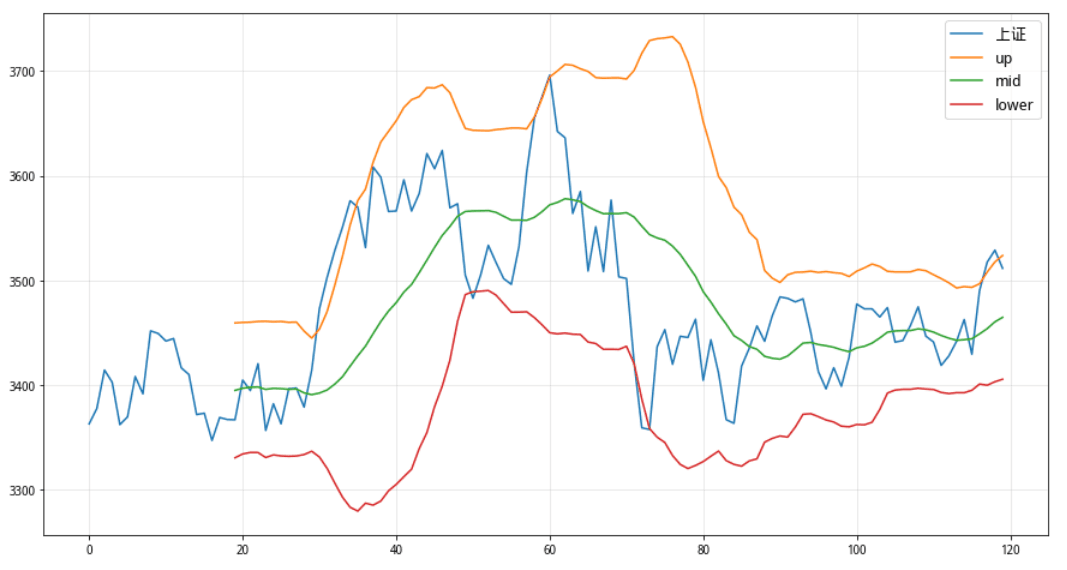

Bol with index data acquisition and drawing demonstration (Shanghai Composite Index)

up,mid,lower=BOLL(CLOSE) #Get brin band data plt.figure(figsize=(15,8)) plt.plot(CLOSE,label='Shanghai '); plt.plot(up,label='up'); #Drawing display plt.plot(mid,label='mid'); plt.plot(lower,label='lower');

Third party libraries need to be installed (TA lib libraries are not required, and pandas can be installed for all indicators)

- pandas